When shipping internationally, landed cost plays a pivotal role in shaping pricing strategies, ensuring customer satisfaction, and staying competitive by maintaining transparency and avoiding unexpected expenses. In this article, we’ll cover the essentials of landed cost, offering expert insights and solutions designed to support direct-to-consumer (DTC) brands in their international growth.

Understanding Landed Cost in International Shipping

Landed cost encompasses the total expenses of delivering a product from your brand to the end consumer, including the initial purchase price, shipping fees, and any charges imposed by the destination country, such as customs duties and taxes. This comprehensive figure is essential for setting appropriate prices and ensuring transparency with consumers.

How to Calculate Landed Cost:

Calculating the landed cost for international shipping involves summing up the product’s price, shipping costs, customs duties and taxes, and any other fees that may apply until the shipment is delivered.

Landed Cost Example

- Product Price – $50

- Shipping Cost – $10

- Duties & Taxes – $5

- Total Landed Cost = $65 (product + shipping + duties/taxes)

In this example, the total landed cost is determined by adding together the product price ($50), shipping cost ($10), and duties and taxes ($5), resulting in a total of $65.

Why Landed Cost Matters in Global Ecommerce

In the competitive landscape of global ecommerce, transparency and accuracy in calculating landed costs are key to overcoming market challenges and boosting international revenue. Here, we’ll explore the top benefits of effectively managing these costs in cross-border transactions.

Benefits of Landed Cost for Global Transactions:

- Improved Customer Experience: Transparency throughout the checkout process is crucial for creating a smooth customer experience. Displaying the landed cost ensures buyers understand all expenses upfront and builds trust by eliminating hidden fees and extra charges upon delivery. This approach not only enhances consumer satisfaction but also fosters loyalty and encourages repeat business, which contributes to a brand’s overall growth and positive reputation.

- Increased Conversion Rates: High shipping costs, along with unexpected duties, taxes, or additional fees, rank as leading factors for cart abandonment in global ecommerce. Integrating landed cost into the total price presented at checkout allows businesses to avoid any surprise costs. This significantly reduces the likelihood of customers leaving your site without completing their purchase, leading to higher conversion rates.

- Compliance & Customs Efficiency: Proper calculation of landed cost ensures that all duties and taxes are accurately accounted for, supporting compliance with international trade regulations. This efficiency in handling customs requirements not only reduces delays and potential penalties but also enhances the customer experience by enabling quicker delivery.

- Enhanced Pricing Strategy: Precise calculation of landed costs allows ecommerce brands to set prices that truly reflect the total cost of delivering products to international customers. This accuracy not only ensures businesses maintain healthy profit margins but also guards against surprise fees, keeping pricing competitive and predictable in the global market.

- Strategic Market Selection: Understanding landed costs across various markets empowers brands to make informed decisions on market entry and product offerings. This strategic insight helps identify markets with higher profitability and lower barriers to entry.

Overlooking the importance of landed costs can lead to significant challenges in international shipping, where inaccurate calculations might result in underpricing products, reducing profit margins, or overpricing, which could deter potential buyers. Additionally, a lack of transparency in costs can negatively impact the customer experience, leading to decreased sales and hindered growth.

Best Landed-Cost Solutions for DTC Brands

While several tools and software options are available for calculating landed costs, not all are created equal. Some offer basic estimates, whereas better options ensure recipients won’t face any unexpected charges at delivery. However, choosing the best solution for global shipping involves more than just accuracy. Other important factors to consider are the ability to apply reduced rates for qualifying products, like nutritional supplements, and the capability to account for compliance documentation that can lower or eliminate duties and taxes, such as those provided by preferential tariff agreements. Additionally, it’s crucial to monitor selling thresholds in specific markets to ensure taxes are only paid when necessary.

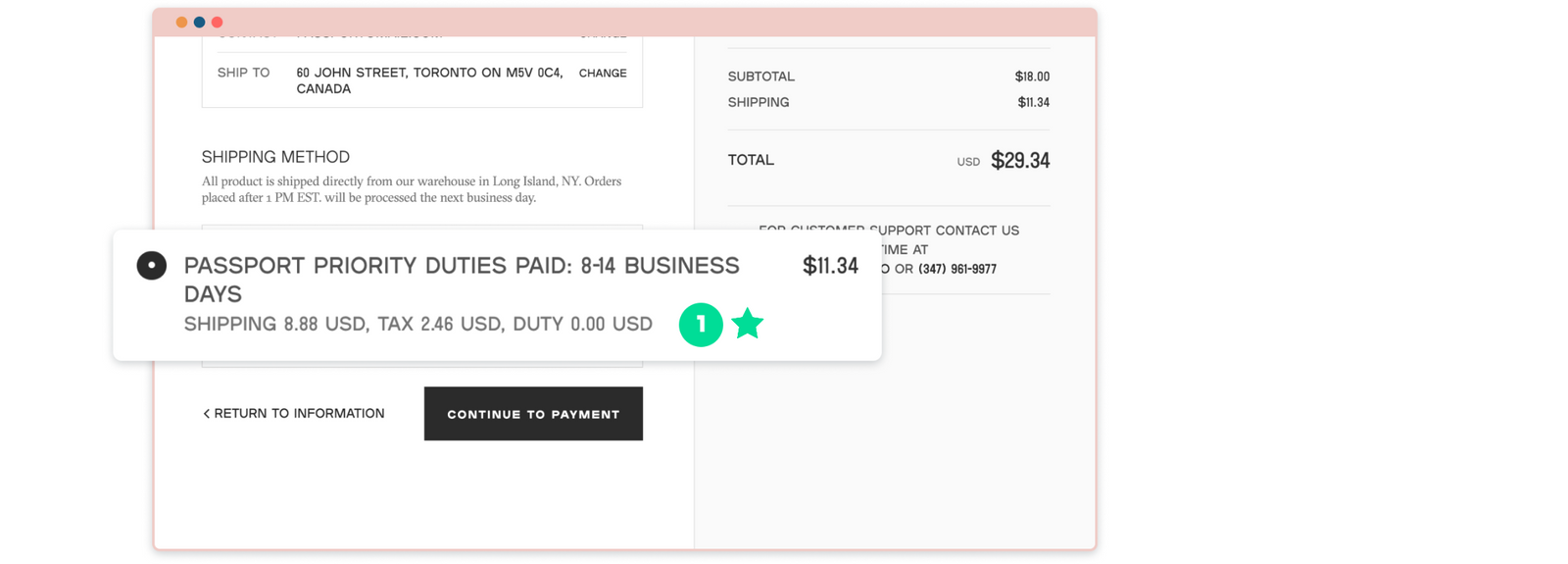

As an international solutions provider, Passport® delivers these services and more, combining innovative technology with an extensive shipping network and in-house expertise. Our easy-to-integrate software makes it simple for DTC brands to implement accurate landed-cost pricing, providing buyers with a transparent cost breakdown at checkout. For an all-in-one internationalization tool, Passport Global™ even includes localization, growth advisory, and compliance services, enabling businesses to adjust their strategies for various markets and effortlessly navigate import regulations. Ready to streamline your global operations with Passport’s landed-cost solutions?

Reach out to our team here to get started.

Frequently Asked Questions:

What is landed cost in international shipping?

Landed cost in international shipping refers to the total expenses involved in getting a product from the seller to the end consumer. This includes the initial purchase price plus all additional costs incurred during transportation, such as shipping fees, customs duties, and taxes.

How do you calculate landed cost?

Landed cost is calculated by adding the product’s price, shipping fees, customs duties, taxes, and any additional charges, resulting in the total cost to the customer.

How are duties calculated for landed cost?

Duties for landed cost are based on the product’s value, country of origin, and its harmonized system (HS) code classification, which determines the applicable duty rate. Accurate HS code determination is crucial as it directly influences the overall landed cost. At Passport, we specialize in precise HS classification, a service where many carriers struggle, ensuring you pay the right amount in duties and avoid customs delays.

What should total landed costs include?

Total landed costs should cover the product’s price, shipping fees, customs duties, taxes, and any other charges associated with delivering the product to the customer.