Highlights of Passport Product Updates for Summer 2024:

✓ Proven growth strategies to capitalize on peak season opportunities and scale effectively

✓ New Canada domestic shipping service for increased operational efficiency and savings

✓ Easier returns with streamlined and customer-friendly processes

✓ Faster shipping with reduced transit times in key international markets

✓ Better tracking with real-time updates in Shopify, email notifications, and more

At Passport, we’re dedicated to continuously enhancing the merchant experience, helping businesses expand into new markets, and ultimately better serve their end customers. Our latest updates for Summer 2024 include exciting new features and significant improvements designed to optimize your ecommerce strategy and boost your global sales. We’ve also made substantial shipping improvements, enabling our brands to better support and deliver to their international buyers.

Maximize Your Peak Season Sales with Passport Global

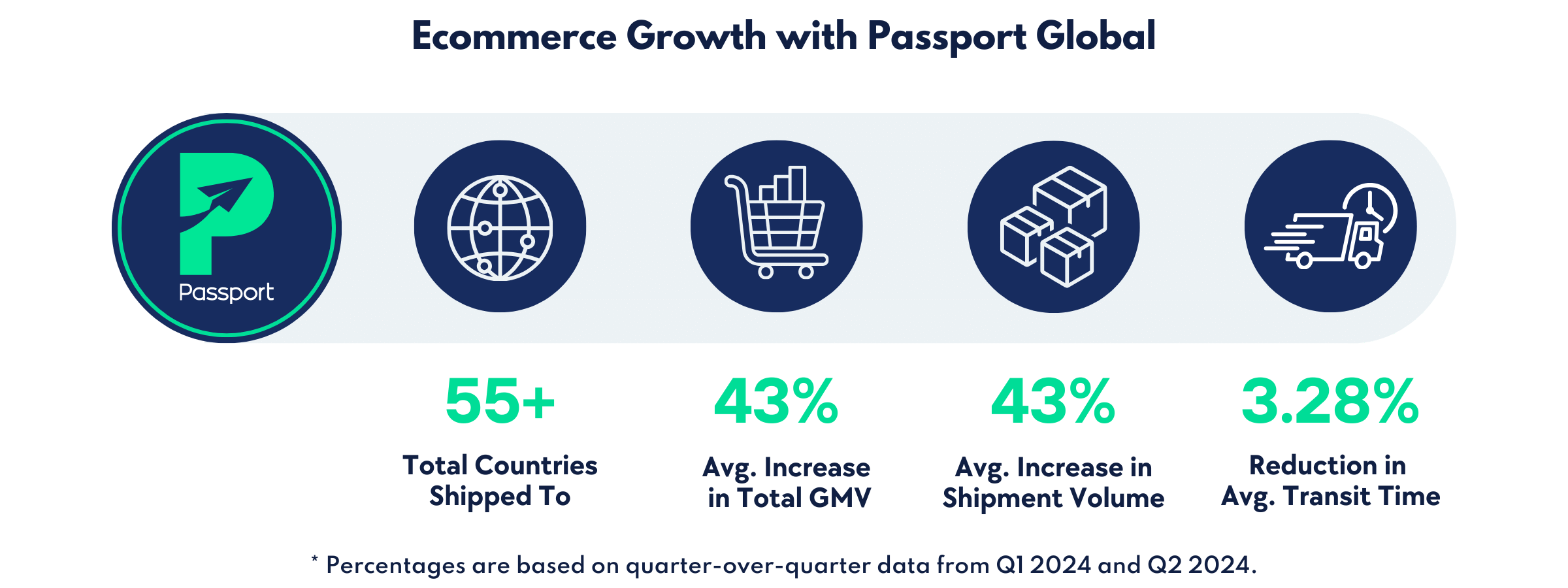

As peak shipping season approaches, companies are preparing strategies to capture and retain international buyers. Your peak season toolkit isn’t complete without Passport Global, which has driven major growth for brands like OneSkin since its official launch in February 2024. Businesses utilizing Passport Global have already achieved impressive early success with 42.73% quarter-over-quarter increase in Total GMV and a 42.7% increase in delivered shipments.

Thinking cross-border expansion is too difficult? You’re not alone. In fact, 82% of business leaders report that compliance challenges influence their decision to enter new markets. [Avalara Survey]

Passport Global eliminates cross-border complexity, empowering brands to easily enter and succeed in new global markets. By leveraging Passport Global, businesses can attract new global buyers and convert them into loyal customers. Our comprehensive services include localization and growth advisory to increase conversions, reliable cross-border shipping that makes your brand look good, and hands-on compliance and customer support to give your team more bandwidth.

Join these top direct-to-consumer brands that have thrived with our expertise and capitalize on international growth during the holiday season and beyond.

New Shipping Services & Features

Providing a reliable shipping and tracking experience is essential to turning buyers into loyal customers. Going into this peak season, we’re excited to share multiple improvements to our Passport Shipping services to give your end-customers a phenomenal buying experience.

1. Canada Domestic Shipping – We’re thrilled to announce the successful launch of our pilot program for domestic shipping within Canada. Now, Passport customers who rely on our trusted international shipping experience can also cost-effectively ship from one Canadian location to another.

This means faster, more efficient domestic deliveries from the same reliable provider that serves over 180 markets worldwide. Plus, with the Shipping Intelligence dashboard available in the Passport Portal, you can view and manage all shipments – both domestic and international – from a single system.

2. Easier Returns – Merchants can now generate return labels directly from the Passport Portal for delivered shipments and send them to their customers, making the returns process more streamlined and user-friendly.

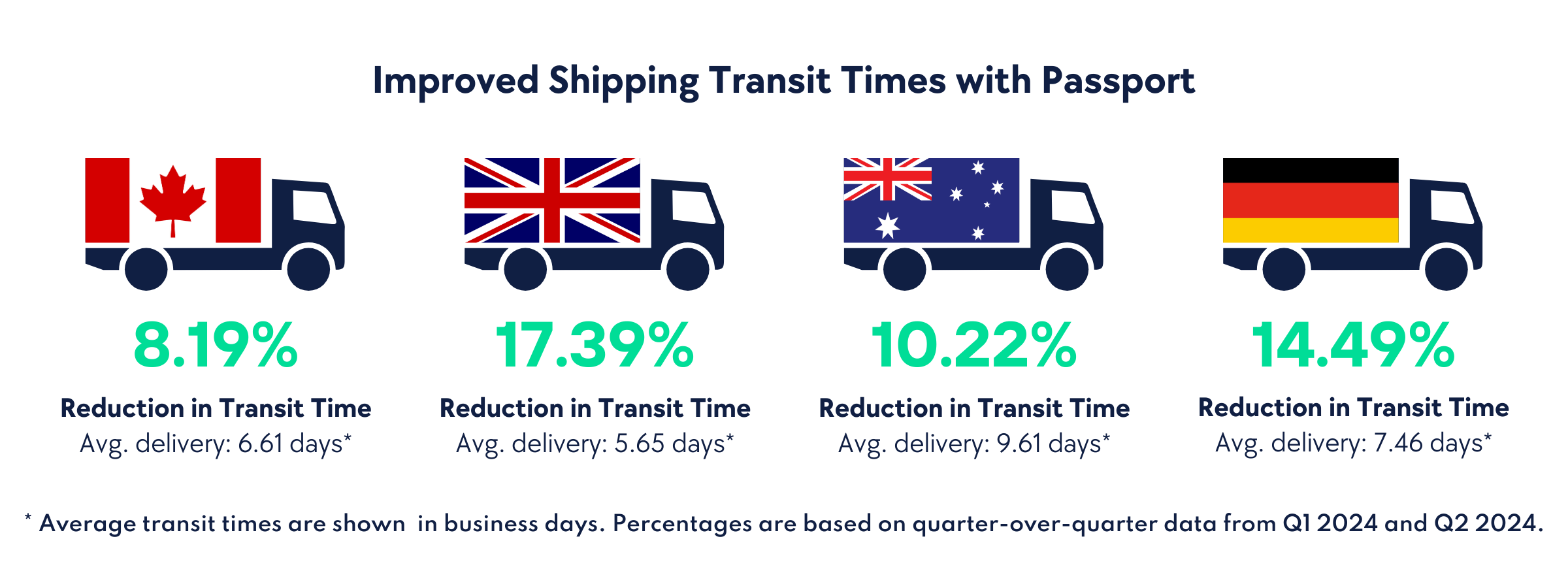

3. Faster Shipping – We’ve significantly reduced transit times to several key markets, resulting in faster deliveries and increased customer satisfaction. So far this year, Passport’s network updates have accelerated delivery times by approximately 8-15% to markets such as Canada, the United Kingdom, Australia, and Germany.

These improvements ensure your buyers receive their orders more quickly, enhancing their overall experience with your brand – leading to more loyal, repeat buyers!

4. Better Tracking and Notifications – To further improve the shipping experience, we’ve introduced several new features that keep you and your customers better informed about your orders.

- Real-time updates in Shopify: This integration ensures that the tracking details in Shopify match the branded tracking page your buyers view, providing consistent information for both you and your customers.

- Photo proof of delivery: Passport has expanded this service in Canada and the UK, offering greater transparency and assurance for deliveries.

- Tracking Enhancements: We’ve made enhancements to the tracking journey, refining the layout and grouping updates by major milestones. These changes make it easier and more intuitive for consumers to follow their shipments at a glance.

- Email notifications: Customers will now receive alerts when their package is ready for pickup from a local point, adding another layer of convenience.

As you consider your peak season strategy, are you leaving money on the table by not providing the right digital and shipping experience to your customers? Let’s fix that – take advantage of this opportunity to maximize profits with Passport! Reach out to our team today to get started.