Streamline with global trade compliance support

Let Passport’s compliance experts handle complex customs, tax, and product regulations so you can focus on growing your brand.

Looking for an all-in-one compliance and shipping solution?

Reduce the stress of global selling

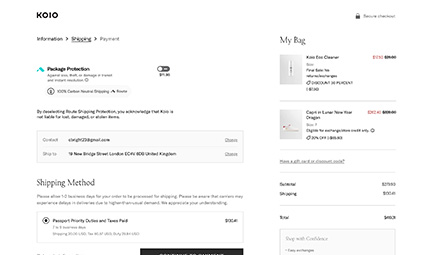

Navigating international markets goes beyond logistics; it requires understanding trade rules, tax obligations, and local standards. With hands-on compliance assistance from licensed brokers, Passport makes it easy to get your products to customers around the world. Pick the services you need, or choose Passport Global – our bundled solution featuring a full suite of compliance services designed to optimize growth.

Simplify Compliance

Ensure smooth customs clearance with dedicated compliance support, including HS classification and product-specific guidance, to effortlessly navigate complex regulations across various countries.

Save Time & Money

Expand efficiently with services that facilitate faster delivery, mitigate risks, and lower expenses through optimal duty/tax rates, accurate landed-cost calculations, and outsourced tax management.

Serve Customers Better

Enhance customer experience with DDP shipping options that provide transparent pricing, seamless delivery, and proactive handling of any customs or carrier issues for a hassle-free process.

Customs & Trade Compliance

With an in-house team of licensed customs brokers and global trade experts, Passport helps you navigate international regulations, preventing costly shipment holds and rejections. We offer product eligibility reviews, commodity classification, proper goods descriptions, accurate customs valuation, optimal clearance recommendations, preferential tariff evaluations, and landed-cost analysis. These services simplify the import process and ensure smooth customs clearance, providing a seamless delivery experience for both brands and their customers.

Fiscal & Tax Compliance

Reach global consumers without establishing a local entity or hiring an expensive accounting firm through our international tax solutions. Passport Seller of Record™ program makes VAT/GST compliance easy by allowing merchants to simply collect required taxes at checkout, while we handle filing returns with the appropriate authorities. Additionally, we provide sales threshold monitoring, indirect tax consulting, and shipment-level reporting, along with duty/tax recovery support, making global selling more manageable and efficient.

Product Compliance

Passport’s product compliance services simplify the process of shipping items internationally by managing the intricacies of health and safety regulations worldwide. We handle everything from market entry research and detailed regulatory assessments to product ingredient reviews and identifying any necessary licenses, certificates, or permits. Our tailored support not only ensures your products meet destination country standards, but also strategically leverages exemptions to optimize entry into global markets.

Navigate international markets with expert support

Schedule an intro call to learn more about our compliance support.

FAQs

Why is global trade compliance important?

What are the top reasons for customs holds?

- Missing Shipment Information

- Incorrect Product Classification

- Unrealistically Low Customs Valuation

- Problematic Goods Descriptions

- Prohibited & Restricted Items

- Delayed Duty/Tax Payments

What is Passport’s Seller of Record Program?

Passport Seller of Record™ (SOR) is a solution designed to give brands a simpler way to handle VAT/GST compliance with a quick and seamless enrollment process. Under the SOR program, companies will use Passport’s tax IDs to clear shipments, avoiding complex registrations and filings. As a merchant, you’ll simply collect VAT/GST at checkout, and Passport will manage the rest, including tax returns with the proper authorities and even monitoring sales thresholds that apply to certain countries.

Passport currently offers SOR solutions in the following markets:

What's the difference between Seller of Record and Merchant of Record?

A third-party Merchant of Record solution acts as an intermediary and sells products on your behalf, assuming the responsibilities associated with financial transactions, tax compliance, and other regulatory requirements. On paper, they are legally recognized as the seller, meaning their company name will appear on bank and credit card statements.

A Seller of Record is a newer alternative that offers a more flexible approach to international tax compliance than a Merchant of Record. While offering a similar solution by enabling brands to outsource their indirect tax collection, reconciliation, and remittance to a third party, SOR distinguishes itself by not being involved in financial transactions with customers. Instead, it allows merchants to choose their own payment platform and directly receive funds.

What are VAT and GST?

In the context of ecommerce, Value-Added Tax (VAT) and Goods & Services Tax (GST) are taxes levied by certain countries on the final consumption of goods and services. Although it’s ultimately paid by end customers, businesses typically collect VAT/GST at the point of sale and then remit the collected amounts to the governing authority in the consumer’s destination country.

VAT is the term commonly used in Europe, while other countries like Australia and New Zealand refer to it as GST. The variations between these international taxes come from the unique regulations each market imposes, including factors like tax rates, items that are tax-exempt, and registration requirements.

What is a distance selling threshold?

A distance selling threshold is a specific limit set by countries on the value of goods sold remotely by non-resident businesses, often through ecommerce transactions. When this threshold is exceeded, businesses must register for a tax ID and comply with local tax laws.

Latest News and Articles

US Merchants Shipping to Canada: How CARM Impacts You

Discover how CARM, Canada’s customs regulation system, impacts US merchants. Learn key requirements and if your business needs to register.

Brazil’s Ecommerce Compliance Program (PRC): Understanding Tax Advantages

Learn about Brazil’s ecommerce compliance program, Programa Remessa Conforme (PRC), offering tax advantages and streamlined customs clearance for DTC brands.

Product Compliance: Ecommerce Guide for Expanding to Global Markets

Learn essential aspects of product compliance for international ecommerce, including key regulations with examples and strategies for navigating global markets.

Merchant of Record: Essential Insights for International Ecommerce

Learn about the Merchant of Record model including its roles, responsibilities, and an alternative approach for seamless international ecommerce transactions.