Get $100 for completing a demo by Dec 31

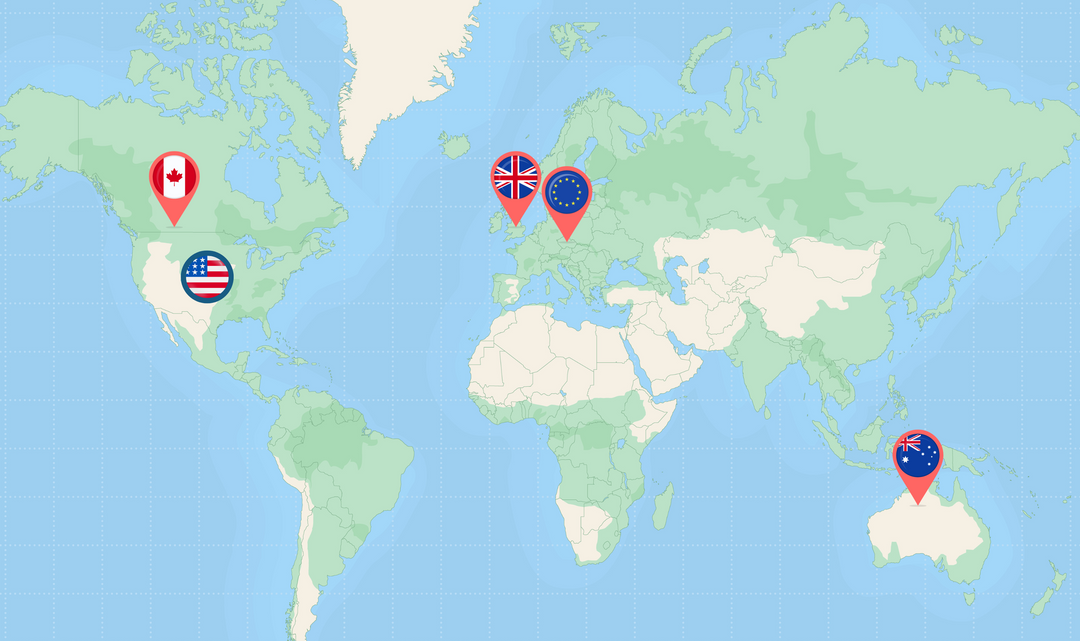

Offer only applicable to North American D2C brands that currently or plan to ship internationally soon through a 3PL. To redeem gift card, you must be a decision-maker or influencer in selecting international vendors. Mention the $100 gift card on the call with Passport before Dec 31st to redeem the offer.